About Claims Service Providers and employer choice

Information on the way workers compensation claims are managed in NSW by our panel of Claims Service Providers (CSP), and how employers might be eligible to choose their CSP.

Workers compensation claims: summary

Claims Service Providers (CSP) are companies that manage claims on behalf of icare. Some CSPs have specialist capabilities, which are detailed below.

Employers with an Average Performance Premium (APP) or Group Average Performance Premium (GAPP) of $100,000 or more, are eligible to choose the CSP that best suits their needs.

icare assigns a CSP to employers with an APP or GAPP under $100,000.

icare continuously reviews the efficiency and effectiveness of our schemes to help ensure we are supporting injured people back to work as soon as possible. We have recently made changes and DXC will no longer form part of our panel of CSPs.

If your policy has been impacted by this change, we’ve prepared an FAQ section below specific to your circumstances.

Page contents

Your Choice of Claims Service ProviderHow are Claims Service Providers performing?

When can I choose my Claims Service Provider?

Frequently asked questions

Brokers and Choice frequently asked questions

Eligible employers can choose one of the following CSPs to manage their policy and any claims; Allianz, EML, Gallagher Bassett, GIO and QBE.

DXC will no longer form part of icare’s panel of CSPs, and employers will not be able to choose DXC to manage their policy. DXC will continue to manage existing claims until all claims have been moved to an alternate CSP.

If you have been impacted by this change, you will be contacted directly.

Generalist with Specialist Capability Providers

Allianz, EML, Gallagher Bassett

- Providers can manage all claim types, including psychological injury claims.

- They offer specific support structures and appropriately skilled and experienced Case Managers, dedicated to managing specialised claims such as psychological injury claims.

How are Claims Service Providers performing?

icare publish Claims Service Provider Quarterly Performance Data that tracks a series of performance measures across workers compensation.

When can I choose my Claims Service Provider?

Eligible employers can select from all Claims Service Providers on icare’s panel of providers.

Please read the Employer Choice Handbook to support you through the process of choosing your Claims Service Provider.

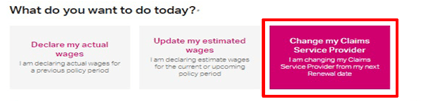

An eligible employer can select a Claims Service Provider via our customer self-service functionality up to 14 days before your policy renews or by contacting your Underwriter.

Since 30 June 2024, employers with an Average Performance Premium (APP) or Group Average Performance Premium (GAPP) of $200,000 or more have been eligible to choose their Claims Service Provider.

From 30 June 2025, we are offering choice to more employers who meet the following criteria:

- Have an Average Performance Premium (APP) of $100,000 or more; or

- Are a part of a group with a Group Average Performance Premium (GAPP) of $100,000 or more.

Employers should make their own assessment when selecting a Claims Service Provider, and if necessary, seek independent professional advice dependent on your circumstances.

Claims Service Provider contact information

Frequently Asked Questions

About the Claims Service Providers

Choice of Claims Service Provider

- How will I know if I am eligible to choose a Claims Service Provider?

- I am eligible, so how do I choose a Claims Service Provider?

- Are all policies under a Group assigned the same Claims Service Provider?

- I'm part of a Group, with multiple policies. What happens if there are changes to the way my group is structured?

- Will these changes affect my policy premium?

- How will I be notified if my policies change provider?

- Will transfer of policies to new Claims Service Providers impact the cost of policies?

- How much communication and collaboration will the Claims Service Providers have with each other before claims transfer?

- Will there be changes to the way we are notified about claims?

- Where can I find out more on policy transfers?

- How can I find out more about all the Claim Service Providers that my clients can choose?

- Are the individual policies within a Group able to independently select their own Claims Service Provider?

- How often are my clients able to change my Claim Service Provider?

- How can my client change their Claims Service Provider?

- Is Claims Service Provider performance data being published, and when?

- As an authorised third-party how do I nominate a new Claims Service Provider for my client?

- When my client changes their Claims Service Provider will my Letter of Authority still apply?

- Will my client’s current portfolio of claims move when it changes Claims Service Provider?

- Will claims transfer on the day my client’s policy transfers?

- What types of claims will not be transferred?

- Will the Claim Service Provider your client selects determine when their claims can transfer?

- What is the impact to injured workers when transferring their claims?

- If your client changes Claims Service Provider, will there be any impact to their policy or premium?

- Why has DXC been removed from the CSP panel of providers?

- My policy is currently at DXC and I have choice of CSP, what do I need to do?

- How can I arrange my policy to be transferred to a new CSP

- How long will it take to transfer my policy to an alternate CSP?

- What happens if I can’t make a selection before 29 August 2025?

- Will my premium change when I move to a new CSP?

- When will my existing claims move?

- When can I commence lodging new claims with my new CSP?

- What happens if I lodge a claim before my policy is transferred to a new CSP?

- How do I understand what services the other CSP’s are offering?

If you need help accessing content on this page, please contact accessibility@icare.nsw.gov.au