icare's claims management service model

The icare claims management service model introduced in January 2018 aims to achieve better outcomes and experience for employers and injured workers. Our model focuses on:

- simplicity

- consistency

- fairness

- transparency

- efficiency

- financial sustainability.

What we're doing

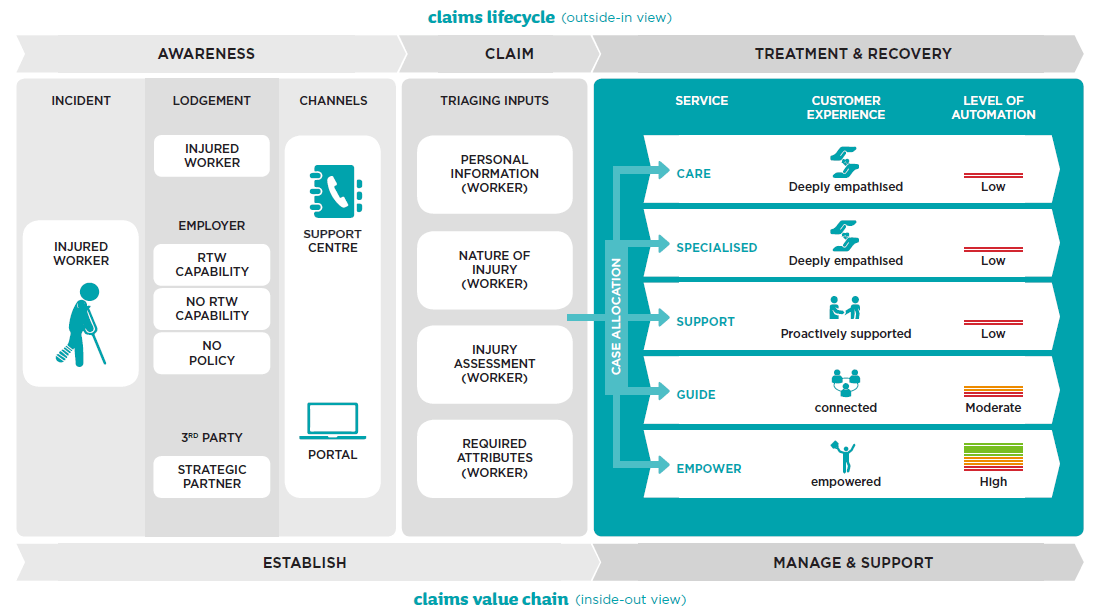

We've designed a model focusing on the customer. It harnesses new technology coupled with highly capable teams to deliver a service aligned to the needs of employers and workers. We want to make the process simpler and faster, which is why we developed a segmented model that ensures appropriate levels of care and management are matched to the circumstances and complexities of the claim.

The employer experience

When lodging a claim, we ask several questions either of the employer or the injured worker. This helps direct the claim to the appropriate level of management, treatment and care.

If the claim is non-complex (e.g. a medical only claim) we reduce the amount of intervention to deliver a faster resolution. We assign more complex claims to highly-trained, experienced case management specialists. Throughout the claim lifecycle a number of flags and additional factors may indicate we need to investigate further, e.g. liability, requiring a change in case management support.

We aim to deliver the best return to work outcomes for injured workers and employers, appropriate to the claim. The new model will make that a much more transparent and equitable process for all involved.

Workers Insurance claims lifecycle and value chain

Liability decisions

Core to the model is quickly directing claims to the right level of support and care. For instance, a simple, light touch experience is where injured workers never take time off following injury. Simple, light touch instances make up 70 per cent of claims. Quickly directing this group of claims helps drive down year-on-year costs and handling expenses.

For claims that require time off work, we may accept provisional liability. This often leads to misunderstandings about the cost impact to premiums and the scheme as a whole.

Year-on-year, we've reduced the number of claims where we accept full liability at first decision. This has dropped from around 30 per cent to 5 per cent. However, we've increased the number of claims where we accept provisional liability, which enables:

- quicker time to treatment, and

- more time to investigate before liability decisions are made.

This change leads to better return to work outcomes. Liability declinature is within 1 per cent of the same period in 2017.

Accepting provisional liability early, where appropriate, allows:

- the worker to get treatment faster,

- leads to a quicker return to work, and

- reduces overall claim costs.

However, giving provisional liability does not mean we accept the claim. We perform a full liability assessment on all claims and involve the right people. We make the final liability decision in line with regulatory requirements.

In the first six months of operation, this has been most apparent in mental health related claims. Mental health related claims typically cost twice that of physical injury claims. Getting faster access to treatment has delivered:

- a 40 per cent improvement in Return to Work outcomes, and

- a 32 per cent reduction in associated cost of weekly benefits for these claims.

Legislation guiding our decisions

Complaints and disputes

The new claims model sees icare leading to transform the dispute resolution process ahead of NSW Government advice. We've also made changes on managing disputes for new claims lodged on or after 1 January 2018. Under these changes, we play a more active role in overseeing and managing disputes in their early stages. The changes allow us to resolve disputes faster and give a better experience for both employers and workers.

We've created a new Dispute Resolution team in Personal Injury to help resolve disagreements about decisions made on claims lodged on or after 1 January 2018. This team is independent of the original decision and have decision making rights. They work closely with employers and workers to resolve disagreements with decisions made affecting an entitlement to benefits (compensation, liability and work capacity disputes).

The dispute resolution team has seen a 13.6 per cent reduction in legal costs in the first half of this year, compared to the same period in 2017.

Types of workers insurance disputes

Medical Support Panel (MSP)

The aim of the MSP is to leverage specialist medical expertise to improve health outcomes and the experience for injured workers and employers.

By reviewing case information, the MSP medical specialists can make timely treatment and medical causation recommendations, assisting case managers in the comprehensive medical management of an injured workers claim.

For an employer and worker this means faster treatment approval for medical interventions and therefore anticipated faster return to work.