What is premium capping and how does it work?

Now that we've explored the NSW premiums model and how pricing works, we're going to take a closer look at some of the more complex aspects of pricing.

Understanding premium capping is an important part of understanding premiums. This is particularly true for employers whose premiums are experience-rated, that is, impacted by their claims performance. These employers may find that their premium is capped when it's time to renew their workers compensation insurance policy.

What is premium capping?

Put simply, premium capping is a limit placed on premium movement in an experience-rated employer's premium rate, which ultimately affects the total premium they need to pay. It helps to keep premiums stable when an employer's claims performance moves significantly.

So, what is a premium rate? In the simplest of terms, an employer’s premium rate is the percentage of premium paid for each dollar of wages, excluding charges and safety incentives.

How do employers know what their premium rate is?

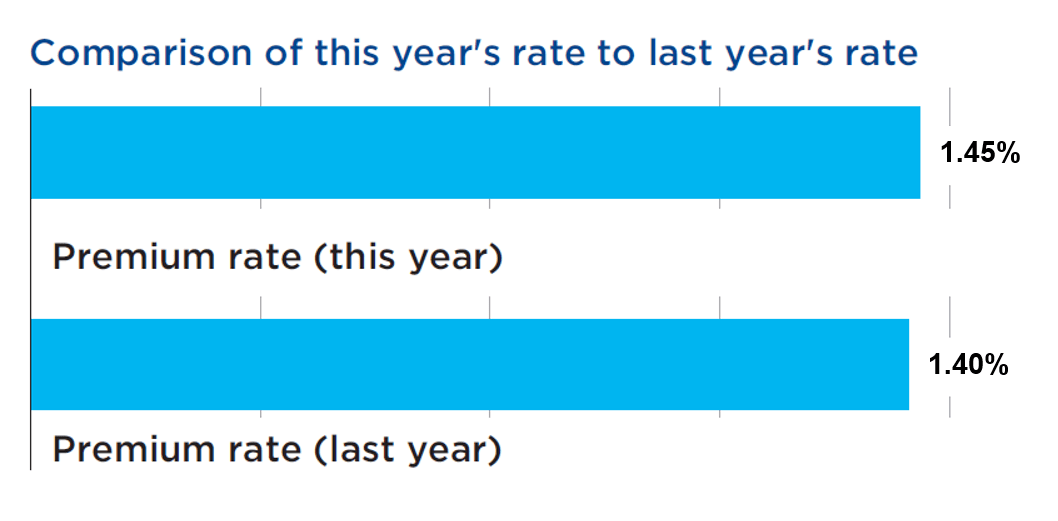

Experience-rated employers can see what their premium rate is, and how it compares to last year's rate, in their renewal policy documentation.

Following feedback from these employers icare has enhanced its policy documentation to help make things simpler and provide the information experience-rated employers need to better understand their premium.

Here's a snapshot of what employers see in their policy renewal pack:

Why was premium capping introduced?

Premium capping was introduced by the regulator, State Insurance Regulatory Authority (SIRA), from 30 June 2018, as a new provision in the Market Practice and Premium Guidelines (MPPGs). It was designed to strengthen premium stability for employers who are subject to claims experience adjustment, especially for those one-off incidents that result in premium spikes.Under this new provision in the MPPGs, insurers must ensure that an employer's premium rate does not increase by more than 30 per cent from the previous policy year due to the employer's own claims experience or due to amendments to an insurer's premium methodology.

In line with keeping the premium pool stable, icare also introduced a limit on premium rate decreases. Under these provisions, approved by SIRA, an employer's premium rate cannot decrease by more than 30 per cent from the previous policy year due to the employer's own claims experience.

Who does premium capping apply to?

Capping is applied to experience-rated policies only. It does not apply to policies under the Loss Prevention and Recovery products which use a different method of calculating premiums based on claims costs rather than wages.

The important thing to note with premium capping is that it can only apply where the increase in premium rate (premium payable before adjustments, divided by wages) is a result of the employer's own claims performance.

Premium capping does not apply as a result of a change in an employer's wages, for example, as their business grows, or as a result of a change in the employer's risk, indicated by their Workers Compensation Industry Classification (WIC) rate.

When is premium capping applied to policies?

Capping is assessed when renewing each policy and every further transaction throughout the policy period.

How is premium capping applied to policies?

When an experience-rated policy is renewed, we compare the employer's premium rate for the renewal against last year's premium rate. If the premium rate movement exceeds 30 per cent, and the increase is due to the employer's claims experience, we cap the premium rate movement at 30 per cent to maintain premium stability.

Let's take a look at some examples of where capping does and does not apply:

| Transaction | Policy year | Wages |

Premium before charges and discounts | Premium rate %* |

Movement % | Outcome |

|---|---|---|---|---|---|---|

| Prior year | 2019-20 | $2,500,000 | $100,000 | 4.00% | 0% | |

| Renewal | 2020-21 |

$2,500,000 |

$130,000 |

5.20% |

30% |

Premium rate capped |

| Transaction | Policy year | Wages |

Premium before charges and discounts | Premium rate %* |

Movement % | Outcome |

|---|---|---|---|---|---|---|

| Prior year | 2019-20 | $2,500,000 | $100,000 | 4.00% | 0% | |

| Renewal | 2020-21 |

$5,000,000 |

$200,000 |

4.00% |

0% |

Capping not required |

*Premium rate equals the percentage of premium (before charges and discounts) divided by wages.

Capping can also be removed in exceptional or contentious circumstances but only with the prior written approval of SIRA.