Future enhancements to the premium model

This week we look closely at future enhancements to the current premium model and what this means for an employer's premium.

Continuing our deep dive into some of the more complex aspects of pricing and the Market Practice and Premium Guidelines (MPPG), in this article we will look at some of the premium model changes that were recommended by the Joint Premium and Prudential Oversight Committee (JPPOC) and submitted in the 2020-21 premium filing for the Nominal Insurer in December 2019.

These recommendations were not rejected by the regulator, State Insurance Regulatory Authority (SIRA), however they remain on hold as we all navigate the impacts of COVID-19.

Enhancement 1: Experience rating below $100,000

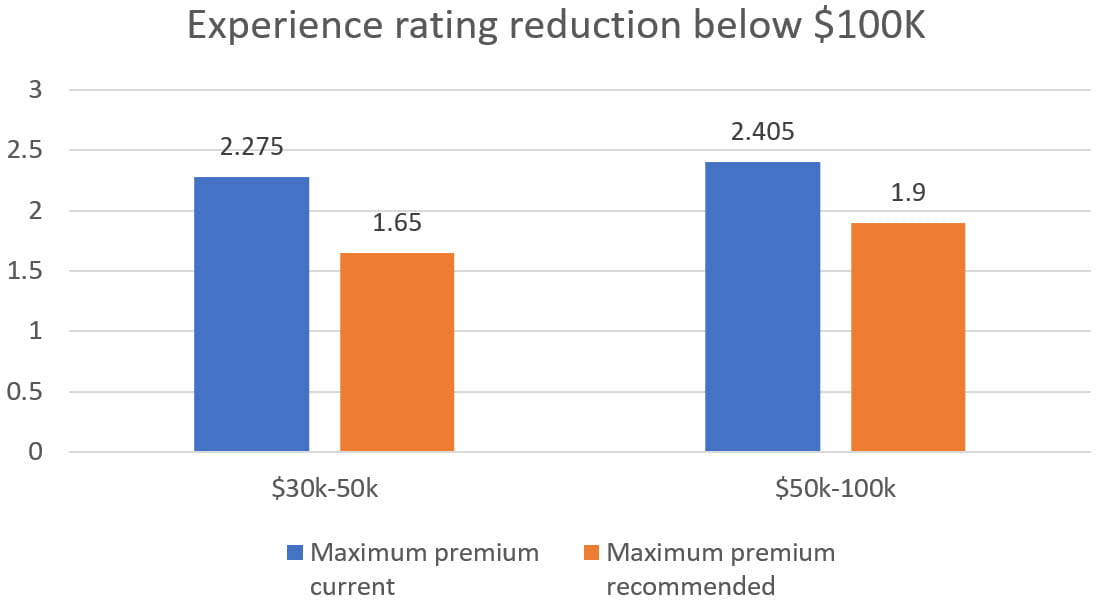

In 2019 the Nominal Insurer recommended a reduction or removal of experience rating for employers with an Average Performance Premium (APP) below $100,000. The analysis completed by the JPPOC showed that 45 per cent of employers with an APP below $100,000 do not have a premium impacting claim over a three-year period. This doesn't provide enough credibility in an employer's safety history to provide stable experience rating.

As an initial step, the 2020-21 Nominal Insurer premium filing reduced the level of experience rating for employers of the two categories below $100,000.

In simple terms, this means the maximum premium increase due to the impact of claims will be reduced by over 20 per cent for these employers.

Enhancement 2: Maximum premiums for all categories (not reached until 600%)

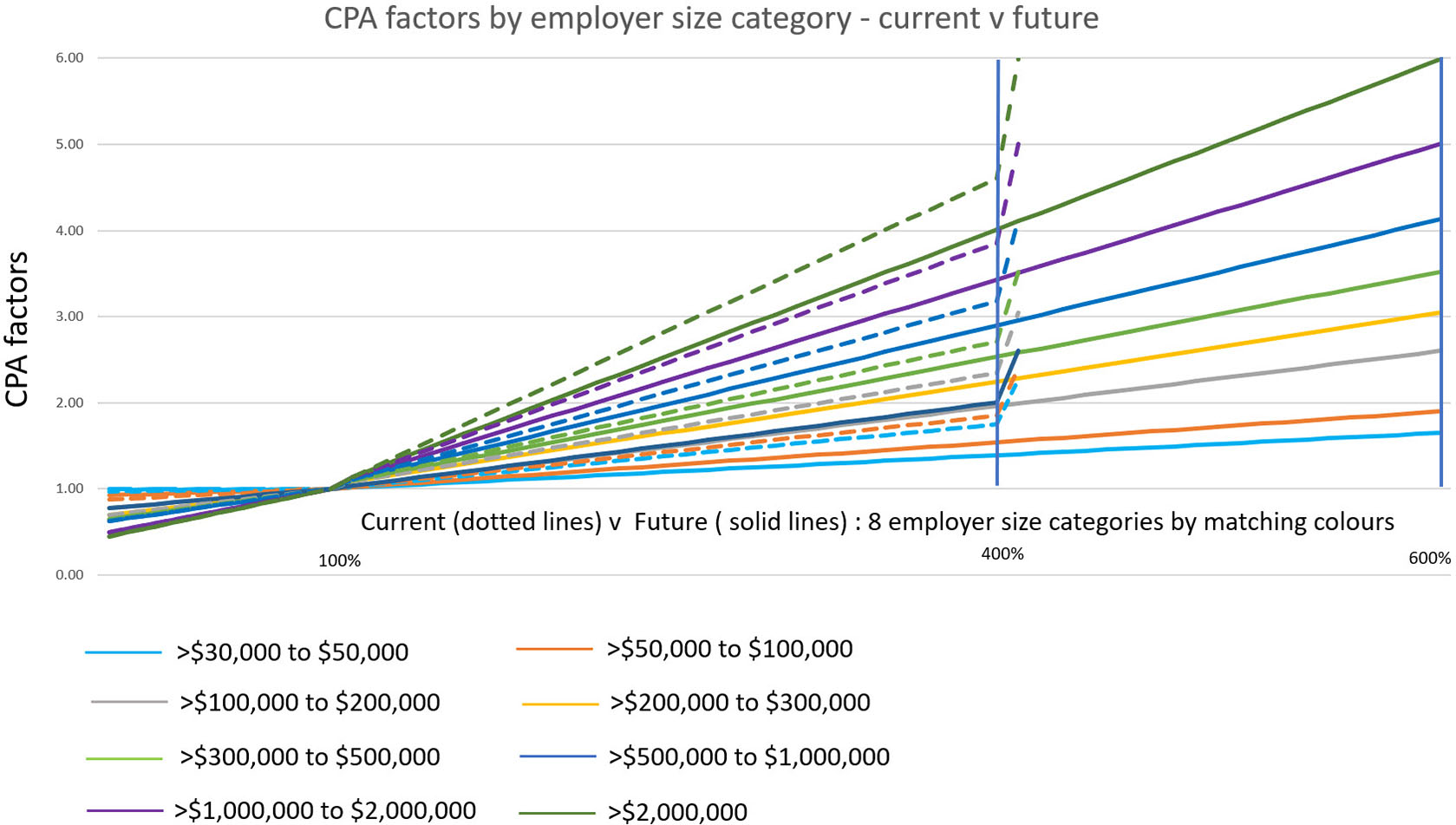

In 2019 the Nominal Insurer recommended a more gradual application of experience rating for all employers. This was supported by the JPPOC.

In the current model, the maximum premium is reached when an employer's claims experience is four times worse (400%) than the scheme performance measure. Within the most recent Nominal Insurer premium filing (which remains on hold) the maximum premium will not be reached until an employer's claims experience is six times higher (600%) than the scheme performance measure.

This means that premium increases due to claims costs will be more gradual, particularly below the 400% performance range. This is illustrated below where the dotted lines represent the current Claims Performance Adjustment (CPA) factors and bands, and the solid lines represent the future CPA factors and bands.

Enhancement 3: Removal of adaptive maximum premiums

Within the current premium model there is an adaptive maximum premium which is applied when an employer's premium is at the maximum premium for more than one year. The adaptive maximum premium was removed from the most recent premium filing that remains on hold due to COVID-19.Enhancement 4: Reducing the impact of grouping on premium stability

As discussed in the previous article, icare is supportive of the principles of grouping and its inclusion within the MPPGs. However, when the JPPOC reviewed the premium model, grouping was shown to create large premium swings in either direction for smaller employers within large groups.

Read more in Pricing in the Nominal Insurer - what have we learnt about the pricing model.

icare has submitted alternative options to the JPPOC for consideration to provide greater premium stability for these employers. Like all considerations this is a matter of balance, as creating a more stable premium for the smaller employers within a group is likely to impact the larger employers within the group, particularly if the small employer has premium impacting claims.

Over the coming weeks we look at the role we can all play in injury prevention and the impacts of COVID-19 on the Nominal Insurer so far. In the meantime, you can learn more about workers insurance premiums including the full details of how a premium is calculated on our How to lower your workers insurance premium page.